I feel your pain, your panic even. How do you plan when you have no idea what’s around the corner? I don’t have the precise answer but I can share my experiences.

This is a TL;DR read. Key messages:

- This is bad. The economy is probably 3-5x worse than what you are planning for

- Make hard decisions fast, build a flexible cost model

- Communicate with your team 3x more than you are now

- Iterate or pivot quickly if your product isn’t selling

- Don’t give up, this is about grit

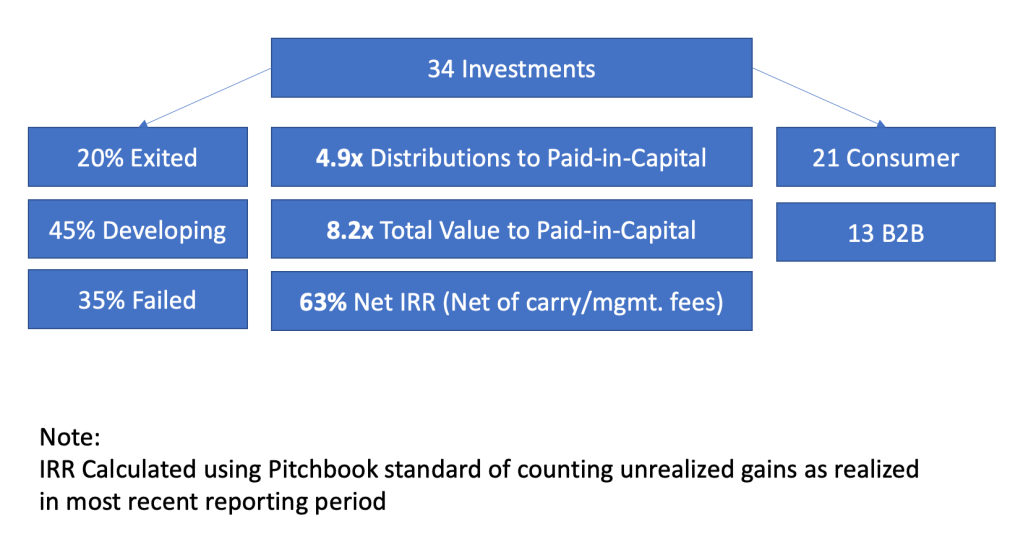

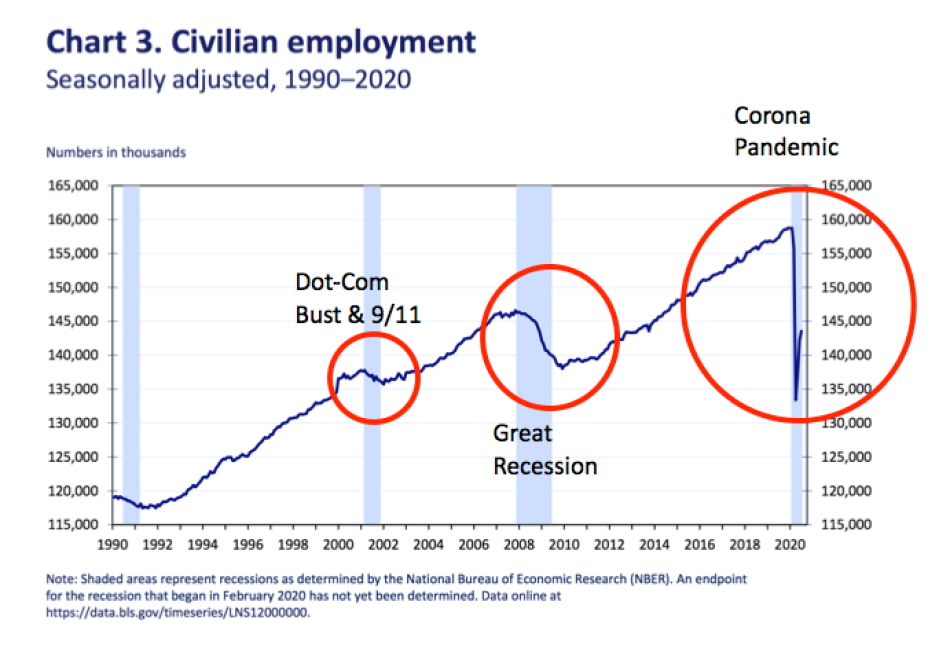

I’ve been through multiple recessions in this century but NOTHING like this. Look up at the red circles in the chart and you’ll see the recessions and associated job loss in the light blue shaded areas. In 2002, I thought my world was ending. Again in 2008. But these look nothing like 2020. The speed and magnitude of loss is shocking. 30 million jobs disappeared in a month. POOF.

In 2000, I was running Organic, Inc. after the dot-com bubble burst. We built websites and did online campaigns for big brands — many in ecommerce. After the bubble burst, no one would even say the word “internet” let alone invest in internet businesses. Startups couldn’t get funding. Companies that were scrambling to build an internet presence stopped cold. Executives and staff building websites at big companies lost their jobs — going from heroes to pariahs overnight. With that, our $100M sales pipeline literally vanished. Poof! It was shocking — like trying to catch a falling knife. It was crushingly difficult but we made it through. How?

We set a plan (one of many), made the hard decisions, cut staff, closed offices, reduced our real estate liabilities, got to break-even, took our publicly-traded company private with private equity money and started growing again. But, it was really messy along the way. Our financial plan was often wrong, especially in the early days. Revenue was like a reverse hockey stick. We underestimated the drop in revenue too often. From this, we learned to do weekly rolling forecasts (iterative planning) where we scrubbed the data until it bled. We carefully watched trends and then reforecast. (Hit Google and you can find examples of how to do these helpful rolling forecasts with waterfall charts) We then did worst case scenarios and planned costs to them. The key was getting to forecasts we could believe in and having the fortitude to make awful, gut-wrenching decisions.

Then, just as things were looking up, 9/11 struck. It was heartbreaking on so many dimensions. Our NYC office was two blocks from the WTC so it closed immediately and staff began remote work, albeit traumatized by what they saw from the office windows on that horrific day.

Within the company, sentiment and revenue became volatile again. People had had enough: rolling staff reductions, promises not kept and the general stress that comes with working in a business with a highly uncertain future. I think we should expect this roller coaster ride with COVID. As we began to grow, we used more contractors so we could avoid lay-offs when revenue disappeared. Cost flexibility was key.

It was no surprise that the private equity firm put immense pressure on us to perform. We were expected to hit our targets, especially profitability. We got there but it was rocky because nothing was certain. Regular forecasting and extreme cost discipline were essential.

I learned a lot about communications in those tough times. As a CEO I wanted to tell the big story, focus on the vision, the future. But these situations become very personal, very individual, for employees. Its about survival. People want to know if the company will live or die and what will happen to their job and when. They want reassurances. They want probabilities. They want timeframes. As a CEO, you’ll know in these times by looking at the numbers, there is no certainty. I’ve read posts on Twitter where people say that if you’re a mission-driven company, employees will give you more latitude. I’m not so sure. People are too smart for a bait and switch. As a CEO it’s ok to say “I don’t know,” to shut up, to listen. In fact, it’s absolutely necessary. I said it all the time. That non answer was in fact an answer. You cannot over communicate. All-hands, small groups, one-on-ones. Zoom, Slack, FaceTime, whatever works for you. Every time I thought I was finished communicating our plan I learned people wanted more information, more insight. Communication wasn’t something you finished. It was something you did. Everyday. It wasn’t just a task it was the job. That being said, action is important. More important than words. Speak. Act. Deliver. That was the only way out of the black hole.

We also made a company-saving pivot towards the budgets in big companies — away from IT (website development) toward marketing (online campaigns). We also invested a lot in UX design before it was cool. Forrester named us a leader in that area. So we had a highly differentiated new service line.

As online advertising kicked into gear again, revenue began growing at a significant clip and the business began delivering record profits. I guess you could say our story had a happy ending. Many didn’t.

Why did we make it? All the things above plus luck. And grit. There were many nights I’d lay in bed going over the massive boulders in our path thinking we wouldn’t make it. The next day, I’d get up and chip away at those boulders. Other teammates felt and did the same thing. Together we reduced the boulders to sand and cleared the path to success. Hard work. Determination.